If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

Elite Quant Plan – 14-Day Free Trial (This Week Only)

No card needed. Cancel anytime. Zero risk.

You get immediate access to:

Full code from every article (including today’s HMM notebook)

Private GitHub repos & templates

All premium deep dives (3–5 per month)

2 × 1-on-1 calls with me

One custom bot built/fixed for you

Try the entire Elite experience for 14 days — completely free.

→ Start your free trial now 👇

(Doors close in 7 days or when the post goes out of the spotlight — whichever comes first.)

See you on the inside.

👉 Upgrade Now →

🔔 Limited-Time Holiday Deal: 20% Off Our Complete 2026 Playbook! 🔔

Level up before the year ends!

AlgoEdge Insights: 30+ Python-Powered Trading Strategies – The Complete 2026 Playbook

30+ battle-tested algorithmic trading strategies from the AlgoEdge Insights newsletter – fully coded in Python, backtested, and ready to deploy. Your full arsenal for dominating 2026 markets.

Special Promo: Use code DECEMBER2025 for 20% off

Valid only until December 20, 2025 — act fast!

👇 Buy Now & Save 👇

Instant access to every strategy we've shared, plus exclusive extras.

— AlgoEdge Insights Team

Premium Members – Your Full Notebook Is Ready

The complete Google Colab notebook from today’s article (with live data, full Hidden Markov Model, interactive charts, statistics, and one-click CSV export) is waiting for you.

Preview of what you’ll get:

Inside:

Fetch and preprocess the vast amount of financial data, in this case the Senators’ Trades

Analyze transactions by type and asset, identify key senators and stocks, and assess trade signal accuracy

Generate visualizations: transaction type bar charts, price trends with transactions, and senator summaries

Automating tracking of Congressional trades using the SEC website with a Selenium

Beautiful interactive Plotly charts

Regime duration & performance tables

Ready-to-use CSV export

Bonus: works on Bitcoin, SPX, or any ticker with one line change

Free readers – you already got the full breakdown and visuals in the article. Paid members – you get the actual tool.

Not upgraded yet? Fix that in 10 seconds here👇

Google Collab Notebook With Full Code Is Available In the End Of The Article Behind The Paywall 👇 (For Paid Subs Only)

Members of the United States Congress have the ability to buy and sell stocks, which can raise concerns about potential conflicts of interest and unfair insider information.

However, given the mandatory public disclosure of their trades, an astute observer who knows how to track these trades could identify invesment opportunities.

This article shows how to examine in detail the individual trades of Senators, indentifying specific asset class traded, the stock market symbol, the transaction date, and the approximate investment amount.

Our primary data source will be the Financial Modeling Prep (FMP) API, which provides access to a comprehensive dataset of stock trades by members of the United States Senate.

Additionally, we will discuss the possibility of tracking these trades manually through the Securities and Exchange Commission (SEC) website, offering an open-source alternative.

We will cover various aspects of working with this data, including:

Fetch and preprocess the vast amount of financial data, in this case the Senators’ Trades

Analyze transactions by type and asset, identify key senators and stocks, and assess trade signal accuracy

Generate visualizations: transaction type bar charts, price trends with transactions, and senator summaries

Automating tracking of Congressional trades using the SEC website with a Selenium

Smarter news. Fewer yawns

Business news takes itself way too seriously.

Morning Brew doesn’t.

Morning Brew delivers a smart, skimmable email newsletter on the day’s must-know business news — plus games that make sticking around a little more fun. Think crosswords, quizzes, and quick breaks that turn staying informed into something you actually look forward to.

Join over 4 million professionals reading Morning Brew for free. And walk away knowing more than you did five minutes ago.

1. Understanding the Data Source

The Financial Modeling Prep (FMP) API provides programmatic access to a comprehensive financial data set, including historical Fundamental Data.

Notably, the FMP API serves as the primary wellspring for extracting detailed transaction information on Senators’ stock trades. You can sign up for the API here.

On the other hand, the Senate’s financial disclosure website serves as the direct source of public records, detailing the financial activities of Senators.

It offers a more manual approach to data retrieval, allowing users to search and view disclosures on individual transactions. With some astuteness, this process can also be automated.

It’s important to note that this analysis concentrates on data pertaining to the Senate. The House of Representatives maintains a separate dataset with similar value for financial disclosure analysis.

We will delve into this data source in a future article to provide a more holistic perspective on congressional trading activity.

Figure 1. Example of a Periodic Transaction Report by a Senator as filed with the Secretary of the Senate.

2. Analyzing Senate Trades with the FMP API

2.1 Retrieving the the dataset

We start by collecting data from the Financial Modeling Prep (FMP) API. This process involves fetching data across multiple pages to compile a comprehensive dataset of 3000 transactions and 13 columns of data.

FMP grants access to a wide array of financial data, including but not limited to, stock market transactions made by members of the United States Senate.

The Python requests library facilitates this data retrieval, parsing JSON responses into a structured pandas DataFrame for analysis. For each page of the API response, we construct a request URL and send a GET request to the FMP API endpoint.

import requests

import pandas as pd

def fetch_senate_trading_data(api_key, pages=30):

all_data = []

base_url = "https://financialmodelingprep.com/api/v4/senate-trading-rss-feed"

for page in range(pages):

url = f"{base_url}?page={page}&apikey={api_key}"

response = requests.get(url)

if response.status_code == 200:

page_data = response.json()

if page_data:

all_data.extend(page_data)

else:

break # Stop if a page has no data

else:

print(f"Failed to retrieve data for page {page}. Status code: {response.status_code}")

break

return pd.DataFrame(all_data)

# Use your API key here

api_key = ""

senate_trading_df = fetch_senate_trading_data(api_key, pages = 30)

# Optional: save the dataframe to a CSV file

# senate_trading_df.to_csv("senate_trading_data.csv", index=False)

senate_trading_df.head(10)

# Use this code if you'd like to download the data from gdrive to continue the analysis later on

'''

import requests

def download_file_from_google_drive(file_id, destination):

URL = "https://drive.google.com/uc?export=download"

session = requests.Session()

response = session.get(URL, params = { 'id' : file_id }, stream = True)

token = get_confirm_token(response)

if token:

params = { 'id' : file_id, 'confirm' : token }

response = session.get(URL, params = params, stream = True)

save_response_content(response, destination)

def get_confirm_token(response):

for key, value in response.cookies.items():

if key.startswith('download_warning'):

return value

return None

def save_response_content(response, destination):

CHUNK_SIZE = 32768

with open(destination, "wb") as f:

for chunk in response.iter_content(CHUNK_SIZE):

if chunk: # filter out keep-alive new chunks

f.write(chunk)

# Use the file ID and specify the destination filename

file_id = '1znOQ7WGZt54c37o7qivIzwscqkRo-qYC'

destination = 'senate_trading_data.json' # Or any other path where you want to save the file

download_file_from_google_drive(file_id, destination)

senate_trading_df = pd.read_json('senate_trading_data.json', lines=True)

print(f"File has been downloaded and saved to {destination}.")

'''

Figure 2. Dataset extracted from the Financial Modeling Prep API showing individual stock market transactions by Senators.

2.2 Most Traded Asset Classes

With the Senate trading dataset in hand, our next objective is to explore the data to identify the asset classes that Senators are most inclined to trade.

If You Could Be Earlier Than 85% of the Market?

Most read the move after it runs. The top 250K start before the bell.

Elite Trade Club turns noise into a five-minute plan—what’s moving, why it matters, and the stocks to watch now. Miss it and you chase.

Catch it and you decide.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

This step shows the diversity of assets under consideration but also sheds light on Senators’ investment preferences and risk appetites.

Utilizing pandas, we segment the data based on two primary dimensions: the type of asset (e.g. stocks, bonds, crypto, etc) and the nature of the transaction (purchase, sale).

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

# Grouping and structuring the data for plotting

grouped_data = senate_trading_df.groupby(['assetType', 'type']).size().unstack(fill_value=0)

# Calculate a 'Total' transactions column for sorting purposes

grouped_data['Total'] = grouped_data.sum(axis=1)

# Sort the DataFrame by 'Total' transactions in descending order and drop the 'Total' column for plotting

grouped_data_sorted = grouped_data.sort_values(by='Total', ascending=False).drop(columns='Total')

# Now, plotting based on the sorted DataFrame

fig, ax = plt.subplots(figsize=(16, 8))

# Recalculate indices for the sorted DataFrame

ind = np.arange(len(grouped_data_sorted))

# Plotting Purchase, Sale (Full), and Sale (Partial) bars based on the sorted data

purchases = ax.bar(ind - width/2, grouped_data_sorted['Purchase'], width, label='Purchase', color='lightgreen')

sales_full = ax.bar(ind + width/2, grouped_data_sorted['Sale (Full)'], width, label='Sale (Full)', color='salmon')

sales_partial = ax.bar(ind + width/2, grouped_data_sorted['Sale (Partial)'], width, bottom=grouped_data_sorted['Sale (Full)'],

label='Sale (Partial)', color='darkred')

ax.set_xlabel('Asset Type', fontsize=14)

ax.set_ylabel('Frequency', fontsize=14)

ax.set_title('Transactions by Asset Type and Transaction Type (Sorted)', fontsize=16)

ax.set_xticks(ind)

ax.set_xticklabels(grouped_data_sorted.index, rotation=45)

ax.legend()

# Adjusting the annotate_bars function to work with sorted data

def annotate_bars(bars, offset=0):

for bar in bars:

height = bar.get_height()

ax.annotate(f'{height}',

xy=(bar.get_x() + bar.get_width() / 2, height),

xytext=(0, offset), # Offset to adjust the annotation position

textcoords="offset points",

ha='center', va='bottom')

# Annotating each category of bars

annotate_bars(purchases)

annotate_bars(sales_full, 3)

annotate_bars(sales_partial, 3)

plt.tight_layout()

plt.show()

Figure 3. Senate Transactions by Asset Type and Transaction Type from 2019 to 2024.

2.3 Distribution of Most Traded Symbols

We progress the analysis by focusing on the distribution of the most actively traded symbols within the Senate’s transaction dataset.

This analysis aims to identify which stocks, bonds, or other financial instruments are favored by Senators and by how much.

To achieve this, the dataset is first augmented to include a numeric representation of transaction amounts, transforming ranges into average values for each transaction.

Subsequently, the dataset is grouped by symbol and transaction type, aggregating the count and sum of average transaction amounts. This step enables the identification of not only the most traded symbols but also the magnitude of transactions associated with each symbol.

For visual representation, a composite bar chart is constructed, delineating the frequency of purchase and sale transactions across the top traded symbols. This chart provides a visual comparison between different securities.

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

import re

# Function to parse and average amounts from the 'amount' column

def parse_amount_range(amount_range):

numbers = [int(n.replace(',', '')) for n in re.findall(r'\b\d[\d,]*\b', amount_range)]

return sum(numbers) / len(numbers) if numbers else 0

# Updated function to simplify amount for display, accommodating both thousands and millions

def simplify_amount(amount):

"""Converts an amount to a string with thousands ('k') or millions ('m') suffix, rounded to 1 decimal place."""

if amount >= 1_000_000:

return f'{amount/1_000_000:.1f}m'

elif amount >= 1000:

return f'{amount/1000:.1f}k'

else:

return str(amount)

# Define the number of top symbols you want to plot

top_n = 25

# Apply the parsing function to each amount and create a new 'avg_amount' column

senate_trading_df['avg_amount'] = senate_trading_df['amount'].apply(parse_amount_range)

# Group by 'symbol' and 'type', then aggregate

grouped_data = senate_trading_df.groupby(['symbol', 'type']).agg(count=('symbol', 'size'), sum_avg_amount=('avg_amount', 'sum')).unstack(fill_value=0)

# Simplify column names

grouped_data.columns = [' '.join(col).strip() for col in grouped_data.columns.values]

# Calculate a total transactions column for sorting

grouped_data['Total transactions'] = grouped_data.filter(like='count').sum(axis=1)

# Sort by total transactions in descending order and select top N symbols

grouped_data_sorted = grouped_data.sort_values('Total transactions', ascending=False).head(top_n)

# Plotting setup

fig, ax = plt.subplots(figsize=(20, 10))

ind = np.arange(len(grouped_data_sorted)) # X locations

width = 0.25 # Bar width

# Plotting bars

types = ['Purchase', 'Sale (Full)', 'Sale (Partial)']

colors = ['lightgreen', 'salmon', 'darkred']

for i, transaction_type in enumerate(types):

counts = grouped_data_sorted[f'count {transaction_type}']

ax.bar(ind + i * width, counts, width, label=transaction_type, color=colors[i])

# Annotation for counts

for j, val in enumerate(counts):

ax.text(j + i * width, val + 0.01 * max(counts), f'{val}', ha='center', va='bottom')

# Adjusted to annotate the sum of avg_amounts instead of the average

for i, transaction_type in enumerate(types):

sum_avg_amounts = grouped_data_sorted[f'sum_avg_amount {transaction_type}']

for j, val in enumerate(sum_avg_amounts):

simplified_amount = simplify_amount(val) # Use the updated function here

count = grouped_data_sorted[f'count {transaction_type}'].iloc[j]

if count > 0: # Only annotate if count > 0

# Positioning slightly above the count annotation, with adjustments for sum

vertical_position = count + 0.05 * max(counts)

ax.text(j + i * width, vertical_position, f'${simplified_amount}', ha='center', va='bottom', fontsize=9, color='blue', rotation=90)

ax.set_xlabel('Symbol')

ax.set_ylabel('Transactions Count')

ax.set_title(f"Top {top_n} Symbols by Transaction Count and Type with labels for Average Total Amount ({senate_trading_df['transactionDate'].min()} to {senate_trading_df['transactionDate'].max()})")

ax.set_xticks(ind + width)

ax.set_xticklabels(grouped_data_sorted.index, rotation=45)

ax.legend()

plt.tight_layout()

plt.show()

Figure 4. Analysis of the Top 25 Most Traded Stock Symbols in the Senate, Highlighting Transaction Counts and Total Average Amounts invested from 2019 to 2024.

2.4 Buy and Sell Signals Across Time

We now examine the temporal dynamics of buy and sell signals within the Senate trading data, focusing on their alignment with market movements. By overlaying transaction data onto stock price timelines, we aim to assess the timing and potential foresight of these trades.

Utilizing yfinance for stock data retrieval and matplotlib for visualization, we plot the closing prices of stocks over time, annotating buy and sell transactions. This visual approach allows for an immediate understanding of how Senate trades are positioned relative to market trends.

Beyond mere visualization, we extend the analysis to quantitatively assess the accuracy of these transactions. This involves calculating the percentage change in stock prices following a transaction, within a defined window (e.g. 30 days).

import yfinance as yf

import matplotlib.pyplot as plt

import pandas as pd

import numpy as np

from matplotlib.lines import Line2D

import matplotlib.dates as mdates # Import for handling date formatting

# Parameters

t_days = 30 # Number of days to check for accuracy

transaction_amount_threshold = 10000 # Amount threshold for visualization

top_n_symbols = 5

# Assuming 'senate_trading_df' is already defined

senate_trading_df['transactionDate'] = pd.to_datetime(senate_trading_df['transactionDate'])

def amount_to_numeric(amount_str):

amounts = [int(s.replace(',', '').replace('$', '')) for s in amount_str.split('-')]

return sum(amounts) / len(amounts)

senate_trading_df['numeric_amount'] = senate_trading_df['amount'].apply(amount_to_numeric)

senate_trading_df['transactionType'] = np.where(senate_trading_df['type'].str.contains('Purchase'), 'Buy', 'Sell')

total_avg_amount_by_date_and_type = senate_trading_df.groupby(['transactionDate', 'symbol', 'transactionType']).agg({'numeric_amount': 'sum'}).reset_index()

start_date = senate_trading_df['transactionDate'].min()

end_date = senate_trading_df['transactionDate'].max() + pd.Timedelta(days=5) # Extend for accuracy check

top_symbols = senate_trading_df['symbol'].value_counts().head(top_n_symbols).index.tolist()

fig, axes = plt.subplots(nrows=len(top_symbols), figsize=(16, 4 * len(top_symbols)), squeeze=False)

#accuracies = []

for i, symbol in enumerate(top_symbols):

ax = axes[i][0]

stock_data = yf.download(symbol, start=start_date, end=end_date)

ax.plot(stock_data.index, stock_data['Close'], label=f'{symbol} Close Price', color='blue')

ax2 = ax.twinx()

ax2.fill_between(stock_data.index, 0, stock_data['Volume'], color='grey', alpha=0.3)

ax2.set_ylabel('Volume', color='grey')

ax2.tick_params(axis='y', labelcolor='grey')

ax2.set_ylim(0, max(stock_data['Volume'])*4)

correct_buy_signals, total_buy_signals = 0, 0

correct_sell_signals, total_sell_signals = 0, 0

symbol_transactions = total_avg_amount_by_date_and_type[

(total_avg_amount_by_date_and_type['symbol'] == symbol) &

(total_avg_amount_by_date_and_type['numeric_amount'] > transaction_amount_threshold)]

for _, row in symbol_transactions.iterrows():

transaction_date = row['transactionDate']

if transaction_date in stock_data.index:

color = 'green' if row['transactionType'] == 'Buy' else 'red'

price_on_transaction = stock_data.at[transaction_date, 'Close']

# Scaling marker size based on transaction amount

# ax.scatter(transaction_date, price_on_transaction, s=np.log(row['numeric_amount'] + 1) * 10, color=color, alpha=0.5) # log scaling

# ax.scatter(transaction_date, price_on_transaction, s=row['numeric_amount'] / 1000 * 10, color=color, alpha=0.5) # linear scaling

ax.scatter(transaction_date, price_on_transaction, s=np.sqrt(row['numeric_amount']) * 5, color=color, alpha=0.5) # square root scaling

ax.axvline(x=transaction_date, color=color, linestyle='--', alpha=0.5)

try:

price_after_t_days = stock_data.loc[transaction_date + pd.Timedelta(days=t_days), 'Close']

signal_correct = (row['transactionType'] == 'Buy' and price_after_t_days > price_on_transaction) or \

(row['transactionType'] == 'Sell' and price_after_t_days < price_on_transaction)

if row['transactionType'] == 'Buy':

total_buy_signals += 1

if signal_correct:

correct_buy_signals += 1

elif row['transactionType'] == 'Sell':

total_sell_signals += 1

if signal_correct:

correct_sell_signals += 1

except KeyError:

# Skip if no price data available for the date after t_days

continue

buy_accuracy = (correct_buy_signals / total_buy_signals) * 100 if total_buy_signals > 0 else 0

sell_accuracy = (correct_sell_signals / total_sell_signals) * 100 if total_sell_signals > 0 else 0

# Collect accuracies for each symbol for further analysis or display

#accuracies.append({'symbol': symbol, 'buy_accuracy': buy_accuracy, 'sell_accuracy': sell_accuracy})

ax.set_title(f'{symbol} - Senate Trades - Buy Accuracy: {buy_accuracy:.2f}%, Sell Accuracy: {sell_accuracy:.2f}% - Transactions over {transaction_amount_threshold}$')

ax.set_xlabel('Date')

ax.set_ylabel('Price')

ax.legend(handles=[Line2D([0], [0], color='blue', lw=2, label=f'{symbol} Close Price'),

Line2D([0], [0], marker='o', color='w', markerfacecolor='green', markersize=10, label='Buy Signal (Marker Size Proportional to Amount)'),

Line2D([0], [0], marker='o', color='w', markerfacecolor='red', markersize=10, label='Sell Signal (Marker Size Proportional to Amount)')],

loc='upper left')

ax.xaxis.set_major_locator(mdates.MonthLocator())

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y-%m'))

plt.setp(ax.xaxis.get_majorticklabels(), rotation=45)

plt.tight_layout()

plt.show()

# Optional: Print or analyze collected accuracies

# print(accuracies)

Figure 5. Top 5 Most traded stocks: showing stock price trends and transaction points by overlaying Senate buy and sell transactions on stock performance, indicating potential predictive signals.

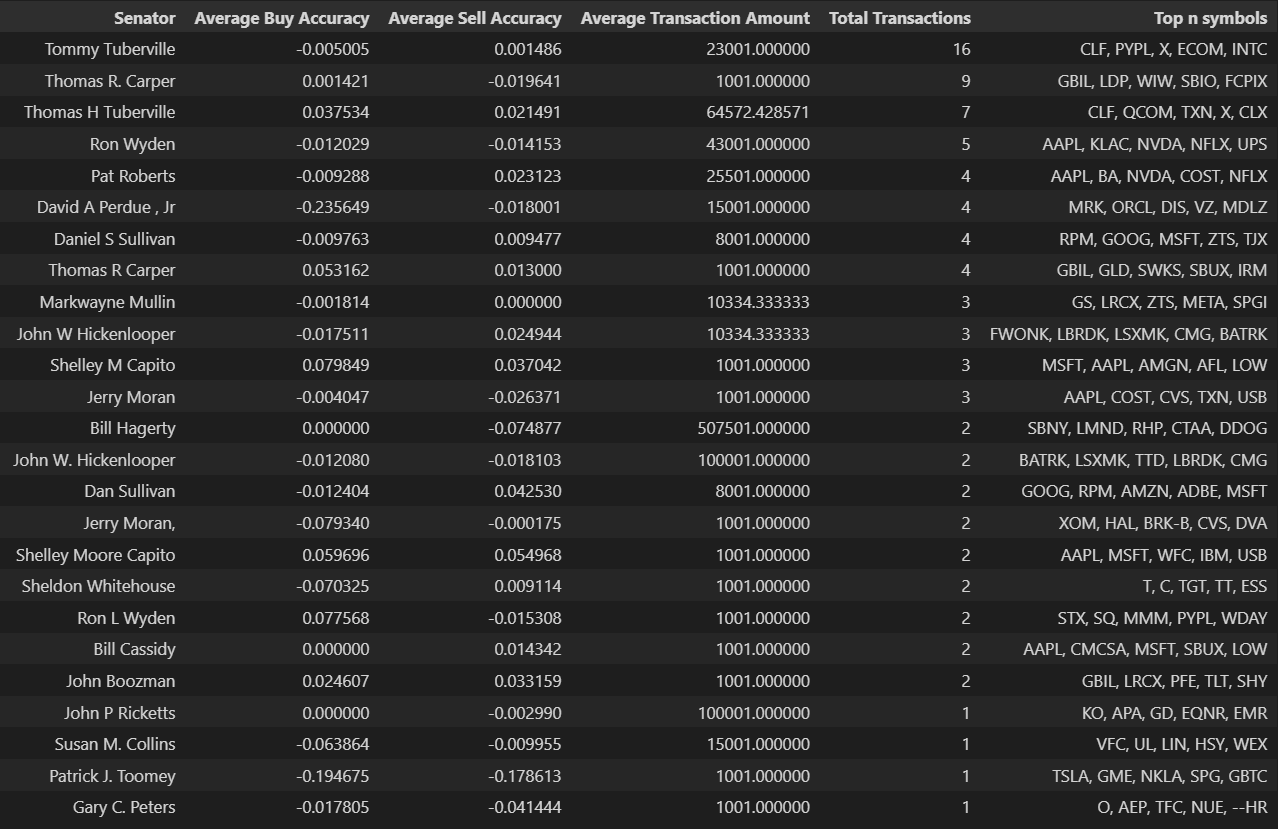

2.5 Trading Accuracy Across Senators

This section aims to quantify the trading performance of Senators by analyzing the accuracy of their buy and sell transactions over a specified period.

By correlating these transactions with subsequent market movements, we establish a metric for evaluating the foresight and financial acumen of individual Senators.

import pandas as pd

import yfinance as yf

from datetime import timedelta

n_days = 30 # Days after the transaction to calculate accuracy

top_n_senators = 25

top_n_symbols = 5

# Combine names, convert dates, and convert amounts

senate_trading_df['Senator'] = senate_trading_df['firstName'] + " " + senate_trading_df['lastName']

senate_trading_df['transactionDate'] = pd.to_datetime(senate_trading_df['transactionDate'])

senate_trading_df['amountNumeric'] = senate_trading_df['amount'].apply(

lambda x: pd.to_numeric(x.split(' - ')[0].replace('$', '').replace(',', '')))

# Determine the top 2 senators and their symbols

top_senators = senate_trading_df['Senator'].value_counts().nlargest(top_n_senators).index.tolist()

top_symbols_per_senator = {

senator: senate_trading_df[senate_trading_df['Senator'] == senator]['symbol'].value_counts().nlargest(top_n_symbols).index.tolist()

for senator in top_senators

}

# Fetch data for unique symbols

unique_symbols = set([symbol for symbols in top_symbols_per_senator.values() for symbol in symbols])

symbol_data = {}

for symbol in unique_symbols:

try:

min_date = senate_trading_df[senate_trading_df['symbol'] == symbol]['transactionDate'].min()

max_date = senate_trading_df[senate_trading_df['symbol'] == symbol]['transactionDate'].max() + timedelta(days=n_days)

data = yf.download(symbol, start=min_date.strftime('%Y-%m-%d'), end=max_date.strftime('%Y-%m-%d'))

if not data.empty:

symbol_data[symbol] = data

else:

print(f"No data found for {symbol}")

except Exception as e:

print(f"Error downloading data for {symbol}: {e}")

# Calculate accuracies for top senators

results = []

for senator, symbols in top_symbols_per_senator.items():

# Initialize lists to store accuracies for buy and sell transactions

buy_accuracies, sell_accuracies = [], []

for symbol in symbols:

transactions = senate_trading_df[(senate_trading_df['Senator'] == senator) & (senate_trading_df['symbol'] == symbol)]

for _, transaction in transactions.iterrows():

try:

# Ensure we have pre-fetched data for this symbol

if symbol in symbol_data:

data = symbol_data[symbol]

# Find relevant prices for the transaction date

open_price = data.loc[data.index >= transaction['transactionDate']]['Open'].iloc[0]

close_price = data.loc[data.index <= transaction['transactionDate'] + timedelta(days=n_days)]['Close'].iloc[-1]

accuracy = (close_price - open_price) / open_price

# Append accuracy based on the type of transaction

if transaction['type'] == 'Purchase':

buy_accuracies.append(accuracy)

else: # Sale

sell_accuracies.append(accuracy)

except Exception as e:

print(f"Error processing transaction for {symbol} on {transaction['transactionDate']}: {e}")

# Compile the results for this senator

avg_buy_accuracy = sum(buy_accuracies) / len(buy_accuracies) if buy_accuracies else 0

avg_sell_accuracy = sum(sell_accuracies) / len(sell_accuracies) if sell_accuracies else 0

avg_transaction_amount = transactions['amountNumeric'].mean()

total_transactions = transactions.shape[0]

results.append({

'Senator': senator,

'Average Buy Accuracy': avg_buy_accuracy,

'Average Sell Accuracy': avg_sell_accuracy,

'Average Transaction Amount': avg_transaction_amount,

'Total Transactions': total_transactions,

'Top n symbols': ', '.join(symbols)

})

# Convert the results into a DataFrame

final_df = pd.DataFrame(results)

# Optionally, sort the DataFrame as needed

final_df = final_df.sort_values(by=['Total Transactions', 'Average Transaction Amount'], ascending=False)

final_df

Figure 6. A tabular summary quantifying the trading accuracy of top Senators and their most traded stocks, measured over a set period.

3. Automating Manual Retrieval Process

Automating the retrieval of Senate stock trades involves three key steps: 1) navigating to and searching the Senate’s financial disclosure website, 2) collecting links to individual reports, and finally 3) scraping the content of these reports.

3.1 Agreement Acceptance and Performing Search

Initially, we handle the mandatory agreement to ensure lawful use of the disclosed information. The Selenium script replicates user interaction to check the agreement box.

Following acceptance, it navigates to the search section, where we apply filters for “Periodic Transactions” to narrow down the data to the most relevant trades.

agree_checkbox = WebDriverWait(driver, 10).until(

EC.element_to_be_clickable((By.ID, "agree_statement"))

)

agree_checkbox.click()

# ...additional navigation and filtering...

Figure 7. Financial Disclosure Website Search Automation using Selenium.

3.2. Retrieve All Links to Reports

After establishing the search criteria, we programmatically page through the search results, capturing links to the individual reports.

This process involves a loop that waits for page elements to load, fetches link attributes, and manages pagination.

all_links = set()

# Loop through pages and collect links

while True:

search_results = driver.find_elements(By.CSS_SELECTOR, "#filedReports tbody tr td a")

for link in search_results:

all_links.add(link.get_attribute('href'))

# ...code to handle pagination...

Figure 8. Example of URLs leading to individual senator transaction reports from the Senate’s financial disclosure website.

3.3. Scrape Content of All Links

With the report URLs in hand, the script opens each one in a new tab, waits for the necessary elements to load, and then extracts the transaction details such as the senator’s name, date, asset type, and amount.

for link in links_subset:

driver.execute_script("window.open(arguments[0]);", link)

# Switch to new tab and wait for data to load

# ...transaction data extraction...

Figure 9. Snapshot of the detailed transaction data extracted from these reports, showing transaction types, amounts, and the involved senators.

4. Implications and Practical Applications

Transparency and Accountability: Public access to information on Senators’ financial activities fosters transparency and accountability. By analyzing these trades, citizens can gain insights into potential conflicts of interest and hold elected officials responsible.

Market Impact: Large-scale coordinated trades by Senators could potentially influence stock prices. However, further research is necessary to determine the extent of this impact.

Policy Implications: Analysis of Senators’ trades can inform the development of policies to prevent insider trading and ensure a level playing field in the financial markets.

Predictive Modeling: While the predictive power of this data is limited, exploratory research could investigate potential correlations between Senators’ trades and future stock price movements and take advantage of potential investment opportunities

Future Research: Further research avenues include exploring the relationship between Senators’ trades and specific legislative actions, analyzing the performance of Senators’ portfolios compared to broader market benchmarks, and investigating potential improvements to financial disclosure regulations for increased transparency.

5. Challenges and Limitations

Data Completeness: Transaction reports filed by Senators might not capture the entirety of their investment activities. Holdings in certain asset classes or accounts outside the reporting requirements might be absent from the data.

Timing Discrepancies: The reported trade dates might not reflect the exact execution time. There can be delays between the actual transaction and its disclosure, potentially hindering a clear understanding of market impact.

Limited Predictive Power: Past trading patterns of Senators don’t necessarily guarantee future success. Market conditions are constantly evolving, and relying solely on this data for investment decisions can be risky.

Data Interpretation: Understanding the context behind each transaction is needed for accurate interpretation. Factors like portfolio diversification strategies, industry expertise, or personal financial needs can influence Senators’ investment decisions

Concluding Thoughts

Analyzing congressional stock trades offers valuable insights into the financial activities of elected officials.

By leveraging publicly available data, we can explore various aspects of these trades, including the asset classes Senators tend to favor, the most actively traded stocks, and the potential effectiveness.

However, it’s crucial to acknowledge the inherent limitations associated with this data.

Incomplete reporting, timing discrepancies, and the difficulty of isolating the precise impact of Senators’ trades on market movements necessitate a cautious approach.

Subscribe to our premium content to read the rest.

Become a paying subscriber to get access to this post and other subscriber-only content.

Upgrade