Hands Down Some Of The Best 0% Intro APR Credit Cards

Balance Transfer cards can help you pay off high-interest debt faster. The FinanceBuzz editors reviewed dozens of cards with 0% intro APR offers for balance transfers and found the perfect cards.

Take a look at this article to find out how you can pay no interest on balance transfers until 2027 with these top cards.

🚀 Your Algo Edge Just Leveled Up — Premium Plans Are Here!🚀

A year in, our Starter, Pro, and Elite Quant Plans are crushing it—members are live-trading bots and booking 1-on-1 wins. Now with annual + lifetime deals for max savings.

Every premium member gets: ✅ Full code from every article ✅ Private GitHub repos + templates ✅ 3–5 deep-dive paid articles/mo ✅ Early access + live strategy teardowns

Pick your edge:

Starter (€20/mo) → 1 paid article + public repos

Builder (€30/mo) → Full code + private repos (most popular)

Master (€50/mo) → Two 1-on-1 calls + custom bot built for you

Best deals: 📅 Annual: 2 months FREE 🔒 Lifetime: Own it forever + exclusive perks

First 50 annual/lifetime signups get a free 15-min audit. Don’t wait—the market won’t.

— AlgoEdge Insights Team

Predicted Market Direction vs Close Price

Stock price predictions are a key part of trading, and machine learning offers powerful tools to make these predictions more accurate.

In this article, we’ll show how to train a Random Forest classifier to predict Tesla’s stock direction using historical data.

We’ll cover the steps involved, explain the features, and discuss why Random Forest is a strong choice for this kind of task.

Does your car insurance cover what really matters?

Not all car insurance is created equal. Minimum liability coverage may keep you legal on the road, but it often won’t be enough to cover the full cost of an accident. Without proper limits, you could be left paying thousands out of pocket. The right policy ensures you and your finances are protected. Check out Money’s car insurance tool to find the coverage you actually need.

Stock Price Prediction

Stock price prediction is an essential aspect of algorithmic trading and investment strategies. By predicting whether a stock’s price will go up (bullish) or down (bearish), traders can make informed decisions.

For this exercise, we will focus on Tesla (TSLA), one of the most volatile and widely followed stocks in the market.

We will use historical data from Yahoo Finance to train a Random Forest classifier, a robust and versatile model that can handle complex, non-linear relationships in data.

Setting Up the Environment

You can find the complete code for this project on my GitHub repository here.

Before we dive into the data, we need to install the necessary libraries using the following code:

%pip install yfinance matplotlib scikit-learn seabornThese libraries include:

yfinance for downloading stock data.

matplotlib and seaborn for visualizing the data.

scikit-learn for implementing the Random Forest classifier and other machine learning tools.

Downloading and Preprocessing Data

Next, we will use yfinance to download Tesla’s historical stock data. We will retrieve the data from 01 January 2010, to 31 December 2023, with a weekly interval.

We start by importing all the necessary libraries we are going to need in this project:

import yfinance as yf

import matplotlib.pyplot as plt

import seaborn as sns

from sklearn.ensemble import RandomForestClassifier

from sklearn.model_selection import train_test_split

from sklearn.metrics import classification_report, confusion_matrix

plt.style.use('dark_background')data = yf.download("TSLA", start="2010-01-01", end="2023-12-31", auto_adjust=True, interval="1wk")

data.head()After downloading the data, we clean it by keeping only the relevant columns (Open, Close, Volume, Low, High), and we ensure the data is in a clean format by setting the columns properly.

data.columns = data.columns.get_level_values(0)

data = data[['Open', 'Close', 'Volume', 'Low', 'High']]Visualizing the Data

Visualizing the data is an important step in understanding its behavior. We will plot the stock’s Open, Close, Low, and High prices over time to get a sense of the price fluctuations.

Plotting Function

# Function to plot individual features

def plot_feature(data, feature, color, title, ylabel):

plt.figure(figsize=(14, 6))

plt.plot(data.index, data[feature], label=feature, color=color)

plt.title(title)

plt.xlabel('Date')

plt.ylabel(ylabel)

plt.legend()

plt.grid(True)

plt.savefig(f"{feature}.png")

plt.show()Open

plot_feature(data, 'Open', 'green', 'Open Price Over Time', 'Open Price (USD)')

Open Price Over Time

Close

plot_feature(data, 'Close', 'blue', 'Close Price Over Time', 'Close Price (USD)')

Close Price Over Time

Volume

plot_feature(data, 'Volume', 'orange', 'Volume Over Time', 'Volume')

Volume Over Time

Low

plot_feature(data, 'Low', 'red', 'Low Price Over Time', 'Low Price (USD)')

Low Price Over Time

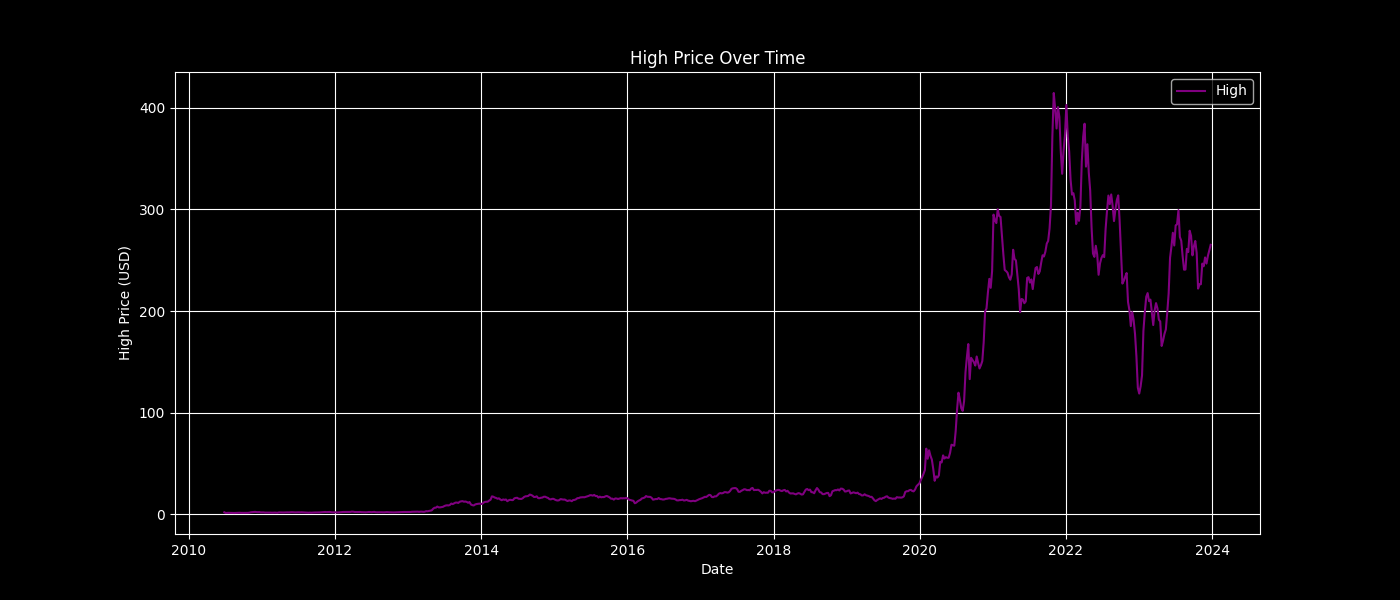

High

plot_feature(data, 'High', 'purple', 'High Price Over Time', 'High Price (USD)')

High Price Over Time

This allows us to observe the historical trends and volatility of Tesla’s stock.

Feature Engineering: Creating the Target Variable

To predict the stock’s direction (up or down), we need to define a target variable.

We will create a new column, “Direction”, which is

1 if the next day’s closing price is higher than the current day’s closing price, and

0 if it’s lower. This will allow us to classify whether the stock is going up or down.

data["Direction"] = (data["Close"].shift(-1) > data["Close"]).astype(int)

data.dropna(inplace=True)Defining Features and Splitting the Data

For feature engineering, we will use the stock’s Open, Close, Low, High, and Volume data as features. These features are commonly used in technical analysis and provide a basis for predicting price movements.

X = data[['Open', 'Close', 'Volume', 'Low', 'High']]

y = data["Direction"]We split the data into training and testing sets, with 80% of the data used for training and 20% for testing. We set shuffle=False to maintain the chronological order of the data.

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=42, shuffle=False)Training the Random Forest Classifier

Now, we can train the Random Forest classifier. This ensemble method builds multiple decision trees and merges them to get a more accurate and stable prediction.

We choose class_weight='balanced' to handle any class imbalance.

model = RandomForestClassifier(n_estimators=100, random_state=42, class_weight='balanced')

model.fit(X_train, y_train)Evaluating the Model

After training the model, we evaluate its performance by predicting the stock’s direction on the test set.

We will also display the classification report and confusion matrix to assess how well the model distinguishes between upward and downward price movements.

Classification Report

y_pred = model.predict(X_test)

print(classification_report(y_test, y_pred)) precision recall f1-score support

0 0.52 0.55 0.54 67

1 0.57 0.54 0.56 74

accuracy 0.55 141

macro avg 0.55 0.55 0.55 141

weighted avg 0.55 0.55 0.55 141Confusion Matrix

cm = confusion_matrix(y_test, y_pred)

sns.heatmap(cm, annot=True, fmt='d', cmap='Blues')

plt.xlabel('Predicted')

plt.ylabel('Actual')

plt.title('Confusion Matrix')

plt.savefig("confusion_matrix.png")

plt.show()

Confusion Matrix

The confusion matrix helps us identify the number of correct and incorrect predictions for both classes (up or down).

Visualizing the Predictions

Subscribe to our premium content to read the rest.

Become a paying subscriber to get access to this post and other subscriber-only content.

Upgrade