🚀 Your Algo Edge Just Leveled Up — Premium Plans Are Here!🚀

A year in, our Starter, Pro, and Elite Quant Plans are crushing it—members are live-trading bots and booking 1-on-1 wins. Now with annual + lifetime deals for max savings.

Every premium member gets: ✅ Full code from every article ✅ Private GitHub repos + templates ✅ 3–5 deep-dive paid articles/mo ✅ Early access + live strategy teardowns

Pick your edge:

Starter (€20/mo) → 1 paid article + public repos

Builder (€30/mo) → Full code + private repos (most popular)

Master (€50/mo) → Two 1-on-1 calls + custom bot built for you

Best deals: 📅 Annual: 2 months FREE 🔒 Lifetime: Own it forever + exclusive perks

First 50 annual/lifetime signups get a free 15-min audit. Don’t wait—the market won’t.

— AlgoEdge Insights Team

If you’ve ever dipped your toes into trading — whether it’s stocks, forex, or crypto — you’ve likely heard of the Moving Average Convergence Divergence (MACD). It’s a mouthful, sure, but it’s also one of the most popular tools traders use to spot trends and make profitable decisions. As a technical content writer with a decade of experience, I’ve seen countless indicators come and go, but MACD remains a timeless classic. Let’s break it down in simple terms, sprinkle in some code for clarity, and explore how to use it to level up your trading game.

The full end-to-end workflow is available in a Google Colab notebook, exclusively for paid subscribers of my newsletter. Paid subscribers also gain access to the complete article, including the full code snippet in the Google Colab notebook, which is accessible below the paywall at the end of the article. Subscribe now to unlock these benefits!

What Is MACD? The Basics Made Simple

At its core, MACD is a trend-following momentum indicator. It tells you whether a stock (or any asset) is gaining or losing steam and hints at when to buy or sell. Think of it as a traffic light for traders: green means go (buy), red means stop (sell).

MACD has three main parts:

MACD Line: The difference between two moving averages (more on this soon).

Signal Line: A smoothed-out version of the MACD Line.

Histogram: The MACD Line and the Signal Line gap show momentum strength.

Here’s the formula in plain English:

MACD Line = (12-day EMA — 26-day EMA)

Signal Line = 9-day EMA of the MACD Line

Histogram = MACD Line — Signal Line

EMA stands for Exponential Moving Average, which is just a fancy way of saying it’s a moving average that gives more weight to recent prices. The numbers (12, 26, 9) are the default settings, but you can tweak them later.

How It Works

When the MACD Line crosses above the Signal Line, it’s a buy signal (bullish).

When it crosses below, it’s a sell signal (bearish).

Let’s see this in action with a quick Python snippet using sample data:

import pandas as pd

# Sample price data (replace with real data from Yahoo Finance or elsewhere)

prices = [145, 146, 148, 150, 149, 151, 153, 152, 154, 155]

# Calculate EMAs using pandas

data = pd.Series(prices)

ema_12 = data.ewm(span=12, adjust=False).mean() # 12-period EMA

ema_26 = data.ewm(span=26, adjust=False).mean() # 26-period EMA

macd_line = ema_12 - ema_26

# Signal Line (9-period EMA of MACD Line)

signal_line = macd_line.ewm(span=9, adjust=False).mean()

# Histogram

histogram = macd_line - signal_line

print("MACD Line:", macd_line.iloc[-1])

print("Signal Line:", signal_line.iloc[-1])

print("Histogram:", histogram.iloc[-1])Run this, and you’ll get numbers showing the latest MACD values. If the MACD Line is above the Signal Line, it’s a bullish hint!

Why Traders Love MACD

MACD is like a Swiss Army knife — it’s versatile and works across markets (stocks, forex, crypto) and timeframes (minutes to months). Whether you’re a day trader scalping quick profits or a long-term investor, MACD has a strategy for you. Let’s dive into the best ones.

5 Killer MACD Trading Strategies

1. MACD Crossover Strategy (The Classic)

This is the bread-and-butter approach:

Buy: MACD Line crosses above the Signal Line.

Sell: MACD Line crosses below the Signal Line.

It shines in trending markets but can trip you up in choppy ones. Pair it with volume or support/resistance levels to avoid false signals.

2. MACD Divergence Strategy (Spot Reversals)

Divergence is when price and MACD tell different stories:

Bullish Divergence: Price hits lower lows, but MACD makes higher lows — time to buy!

Bearish Divergence: Price hits higher highs, but MACD makes lower highs — time to sell!

This is gold for swing traders looking to catch reversals.

3. MACD Histogram Strategy (Momentum Master)

The histogram shows momentum:

Buy: Histogram flips above zero (momentum is picking up).

Sell: Histogram drops below zero (momentum is fading).

Perfect for scalpers who thrive on quick moves.

4. MACD + RSI Combo (Double Confirmation)

Pair MACD with the Relative Strength Index (RSI):

Buy: MACD signals bullish, and RSI is below 30 (oversold).

Sell: MACD signals bearish, and RSI exceeds 70 (overbought).

This combo cuts down on fake-outs.

5. MACD + Moving Average Filter (Trend Booster)

Add a 50-day EMA to filter trades:

Buy: MACD crosses up, and the price is above the 50 EMA.

Sell: MACD crosses down, and the price is below the 50 EMA.

Great for swing trading or intraday setups.

Tweaking MACD: Custom Settings

The default settings (12, 26, 9) work well, but you can adjust them:

Short-term traders: Try 5, 13, and 6 for faster signals.

Long-term investors: Use 24, 52, and 18 for broader trends.

Here’s how to tweak it in Python:

# Custom MACD settings

short_ema = data.ewm(span=5, adjust=False).mean()

long_ema = data.ewm(span=13, adjust=False).mean()

macd_line = short_ema - long_ema

signal_line = macd_line.ewm(span=6, adjust=False).mean()Play with the span values to match your style!

Best Timeframes for MACD

Intraday: 5-minute, 15-minute, or 1-hour charts.

Swing Trading: 4-hour or daily charts.

Long-term: Weekly or monthly charts.

Pro tip: Check multiple timeframes to confirm your trade. A bullish signal on the 1-hour chart is stronger if the daily chart agrees.

MACD in Action: Stocks and Indexes

MACD loves liquid stocks (think S&P 500 or NIFTY 50) and volatile names for intraday plays. Use the histogram to spot early trend shifts for indexes like the Dow Jones or NASDAQ.

Risk Management: Stop-Loss and Targets

No strategy is complete without a safety net:

Stop-Loss: Place below recent lows (for buys) or above recent highs (for sells).

Targets: Aim for key support/resistance levels or a 1.5x-2x risk-reward ratio.

Trail your stop as MACD moves in your favour to lock in profits.

Is MACD the Holy Grail?

Not quite. MACD is fantastic for trends, but it’s not perfect. It can lag in sideways markets, so don’t rely on it alone. Combine it with price action, volume, or tools like Bollinger Bands for the best results.

Here’s a bonus idea: Add volume to your Python code:

# Assuming volume data is available

volume = [1000, 1200, 1500, 1400, 1300, 1600, 1700, 1650, 1800, 2000]

if macd_line.iloc[-1] > signal_line.iloc[-1] and volume[-1] > pd.Series(volume).mean():

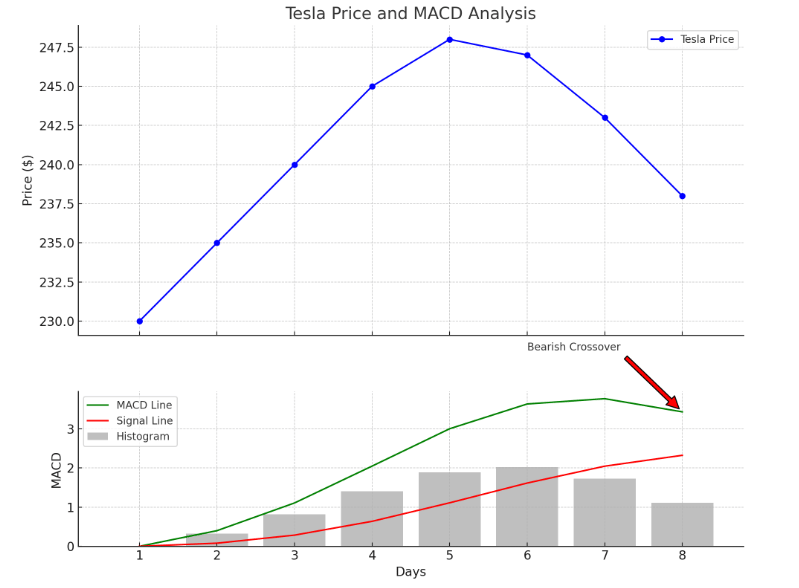

print("Strong Buy Signal!")Imagine it’s mid-2022, and Tesla’s stock has been on a rollercoaster. The price shows signs of exhaustion after a sharp rally earlier in the year — higher highs on the chart, but momentum seems to be fading. A trader wants to know: Is this rally about to reverse into a downtrend, and should I sell (or short)? The challenge is avoiding a false signal, as Tesla is notoriously volatile, and choppy sideways moves can trick you into acting too soon.

Step-by-Step Solution with MACD

Let’s use MACD to tackle this. We’ll assume daily price data for Tesla around June 2022 (a volatile period post-split announcement speculation). The default MACD settings (12, 26, 9) will guide us: the MACD Line (12-day EMA minus 26-day EMA), the Signal Line (9-day EMA of the MACD Line), and the Histogram (MACD Line minus Signal Line).

Step 1: Gather Hypothetical Data

Since I can’t fetch live data, let’s simulate Tesla’s daily closing prices based on typical behaviour in mid-2022 (you’d normally pull this from Yahoo Finance or a trading platform):

Day 1: $230

Day 2: $235

Day 3: $240

Day 4: $245 (higher high)

Day 5: $248 (higher high)

Day 6: $247

Day 7: $243

Day 8: $238

The price is climbing to $248 (a peak) but then starts dipping. Is this a reversal or just a pullback?

The full end-to-end workflow is available in a Google Colab notebook, exclusively for paid subscribers of my newsletter. Paid subscribers also gain access to the complete article, including the full code snippet in the Google Colab notebook, which is accessible below the paywall at the end of the article. Subscribe now to unlock these benefits!

Step 2: Calculate MACD

Using Python, we’ll compute the MACD componen…

Subscribe to our premium content to read the rest.

Become a paying subscriber to get access to this post and other subscriber-only content.

Upgrade