Please, before using this strategy, use it with simulated trading so that you can master it.

The Strategy

I’ll try to keep everything simple and explain how to trade using this strategy.

Every day after the market closes:

Look for stocks that made a big move up during after hours (at least 10%), see why they’re moving and if it’s because of news add them to your stock watchlist A

Look for stocks that made a big move down during market hours (at least 15%), see why they’re moving and if it’s because of news add them to your stock watchlist B

The next day 1 hour before the market opens:

Check stock prices in watchlist A and keep only those that have cooled down in after-hours pre-market

Check stock prices in watchlist B and keep only those that made a move up of less than 5% in after hours and pre-market

What now?

Usually the stocks that are left from the A watchlist will make another big run in the first hour of the market before cooling off again, you have to ride them for a quick buck.

Usually stocks left in the B watchlist will bounce and start to rise slowly during the day creating a good daily trading opportunity, chart them and set your stop losses and take profits on historical supports

EXAMPLES

Case 1 $BNTC — GOOD TRADE — EXAMPLE OF WATCHLIST A

On Wednesday during the after hours I noticed that BNTC was making a huge run and I shared the chart with some friends noting: “If it cools off in premarket tomorrow we have a potential runner”.

The next day, an hour before the market opened, it cooled down and looked like this, and as you can see right after that when the market opened it did another 25% run before cooling down again. A beautiful quick trade.

BNTC Chart

Case 2 $IHT — BAD TRADE — EXAMPLE OF WATCHLIST A

On Thursday during after hours I noticed that IHT was making a huge run and added it to my watchlist A, the next day I checked again and it was still up so I removed it, but a lot of traders due to FOMO ended up buying at the market opening and losing money as there was a lot of selling pressure from traders taking profits from the day before.

IHT Chart

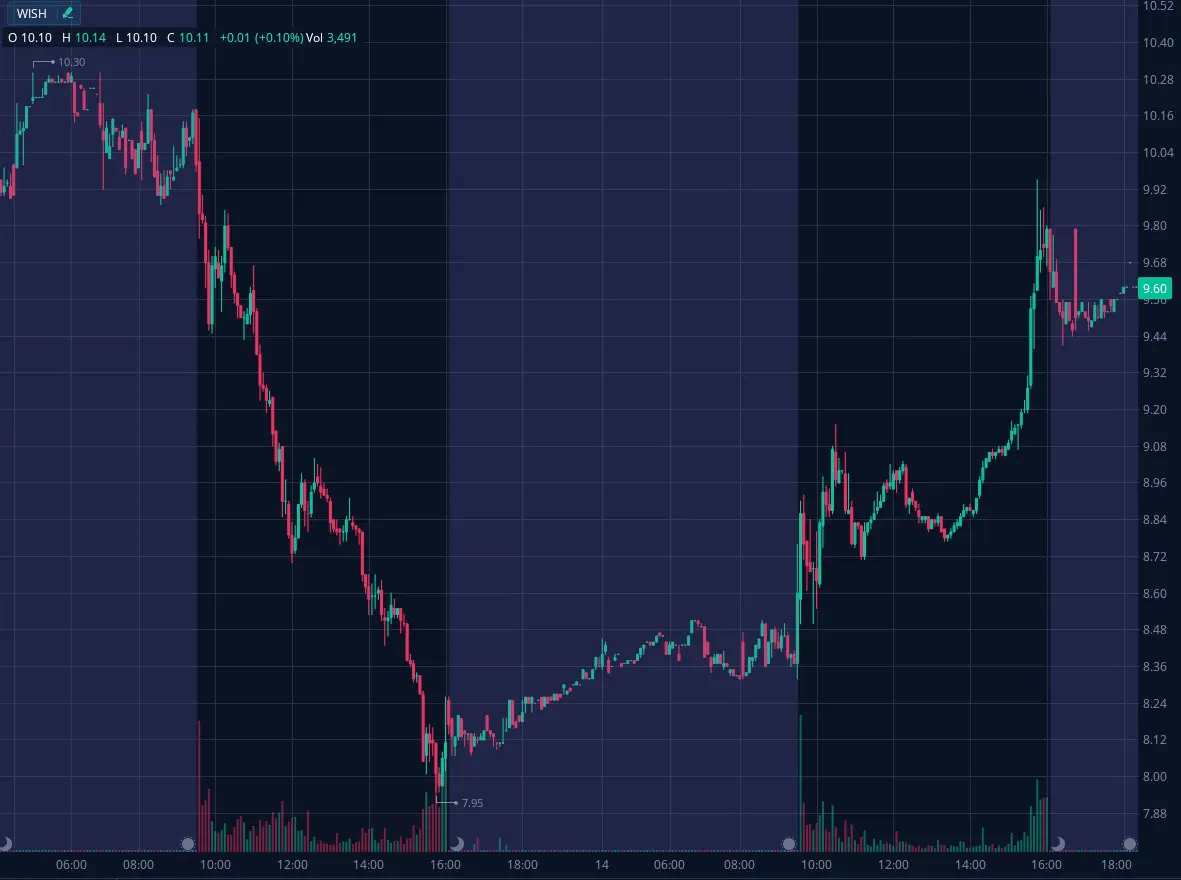

Case 3 $WISH — GOOD TRADE — EXAMPLE OF WATCHLIST B

Wednesday during after hours I noticed that WISH plummeted 30% during the day and added it to my B watchlist. The next day I checked again and it was slowly rising during the pre-market and I shared it with the members of my discord. Indeed, as predicted, it rebounded and on Friday made a 20% move!

WISH Chart

Conclusion

By putting this strategy into practice you will learn which news is good to trade and which is not, when to buy and when not to, etc. If you need help I always reply to all private messages here and I would appreciate if you would follow me here on reddit so you can see all my future posts here!

I hope you’ll master this strategy and appreciate my work! And check my old posts for more daytrading examples!