Colorado’s Top Brewery is Opening Brand New Doors

Some companies make hollow promises to investors. Others use investments to unlock scale. That’s Westbound & Down’s story. Already Colorado’s most-awarded craft brewery, they invited investors to help open a flagship Denver-metro-area location. Hundreds joined, rapidly setting that Denver location in motion. But what comes next is even more exciting. With 4X distribution growth planned by 2028, share in W&D’s growth as an investor today.

This is a paid advertisement for Westbound & Down’s Regulation CF Offering. Please read the offering circular at https://invest.westboundanddown.com/

Elite Quant Plan – 14-Day Free Trial (This Week Only)

No card needed. Cancel anytime. Zero risk.

You get immediate access to:

Full code from every article (including today’s HMM notebook)

Private GitHub repos & templates

All premium deep dives (3–5 per month)

2 × 1-on-1 calls with me

One custom bot built/fixed for you

Try the entire Elite experience for 14 days — completely free.

→ Start your free trial now 👇

(Doors close in 7 days or when the post goes out of the spotlight — whichever comes first.)

See you on the inside.

👉 Upgrade Now →

🔔 Limited-Time Holiday Deal: 20% Off Our Complete 2026 Playbook! 🔔

Level up before the year ends!

AlgoEdge Insights: 30+ Python-Powered Trading Strategies – The Complete 2026 Playbook

30+ battle-tested algorithmic trading strategies from the AlgoEdge Insights newsletter – fully coded in Python, backtested, and ready to deploy. Your full arsenal for dominating 2026 markets.

Special Promo: Use code WINTER2025 for 20% off

Valid only until December 31, 2025 — act fast!

👇 Buy Now & Save 👇

Instant access to every strategy we've shared, plus exclusive extras.

— AlgoEdge Insights Team

Premium Members – Your Full Notebook Is Ready

The complete Google Colab notebook from today’s article (with live data, full Hidden Markov Model, interactive charts, statistics, and one-click CSV export) is waiting for you.

Preview of what you’ll get:

Inside:

How to extract real-time VIX futures term structure data

What the level, slope, and curvature of the VIX curve show

How to visualize curve shifts and spot market regime changes

Interpretation of contango, backwardation, and event risk patterns

How to measure and track VIX carry spreads (short-term vs long-term)

Breaking down term structure moves into level, slope, and curvature

Using a constant-maturity 30-day VIX futures index as a volatility signal

Free readers – you already got the full breakdown and visuals in the article. Paid members – you get the actual tool.

Not upgraded yet? Fix that in 10 seconds here👇

Google Collab Notebook With Full Code Is Available In the End Of The Article Behind The Paywall 👇 (For Paid Subs Only)

Investors watch the VIX tick higher and assume they see fear, but don’t understand what it really means.

A single VIX number tells you almost nothing about where risk sits in the market. However, the term structure, instead, tells you everything.

For instance, if the entire curve shifts up, the market prices in uncertainty everywhere. If instead the front spikes and the back stays flat, the market expects a short-term shock.

We focus on the VIX term structure because it answers questions the index alone cannot:

Does the crowd expect a crisis next week or three months from now?

Is the market bracing for a known event, or does fear stretch across the entire curve?

When does panic actually show up and when does it fade?

The complete Python notebook for the analyses presented here are provided below.

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 25 sales have delivered net annualized returns like 14.6%, 17.6%, and 17.8%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

1. Why VIX Term Structure Matters

CBOE formally defines the VIX as the square root of a weighted blend of option prices that replicate a 30-day variance swap on the S&P 500.

In simpler terms, VIX reflects the market’s consensus on how much volatility lies ahead for the next 30 days.

Every news outlet calls it the “fear index”. That’s not wrong, but it’s incomplete.

What the headline VIX hides:

It only covers one maturity (30 days).

It ignores how fear moves across time.

It misses where risk concentrates, e.g. right now or months from now.

What Is the VIX Term Structure?

The VIX term structure tracks the price of volatility for every future month. One curve for each trade date, built from VIX futures.

Each point: “What does it cost to hedge against market swings for this expiry?”

The curve: “Where do traders expect risk to cluster, e.g. immediately, or later?”

With this, you get to see how nervous the market is and also when.

There are two main VIX term structure regimes:

Contango: The curve slopes upward. Short-term futures trade below long-term. The market expects volatility to fade over time. This is the normal state.

Backwardation: The curve slopes downward. Short-term futures trade above long-term. The market expects immediate risk or panic. This is rare and signals stress.

These regimes are illustrated in the animation below. We’ll discuss it in greater detail later.

Figure 1. The Shape difference of a Contago and Backwardation Regime in the VIX Term Structure. Plot created by author.

How to Read the VIX Curve: Level, Slope, Curvature

Level:

Level measures the average height of the VIX term structure. If the whole curve rises, every expiry costs more.

Markets expect high volatility across all horizons. Sustained high levels signal persistent macro stress.

When level jumps, every risk model needs to adjust. Option sellers may step back. Hedgers pay up. ETF roll costs spike.

Figure 2. VIX Term Structure Level Shift Illustration. The entire curve moves up and down together. Shows market repricing overall volatility. Plot created by author.

Slope:

Slope shows the difference between short-term and long-term volatility.

A positive slope means contango: long-term futures trade above the front. The market expects fear to fade.

Most of the time, VIX futures sit in contango. This structure also creates carry, i.e. short-term volatility recovers faster than long-term volatility.

A negative slope means backwardation: front contracts trade above the back. Panic is here. Markets demand immediate protection.

This only happens in true stress events, e.g. crashes, liquidity shocks, major policy surprises or political events.

Figure 3. VIX Term Structure Slope Shift Illustration. Back end pivots while the front stays fixed. Displays steepening and flattening only. Plot created by author.

Curvature:

Curvature captures how the middle of the curve sits relative to the ends.

A positive curvature forms a hump: the market sees more risk in the mid-term than either end.

Traders brace for a specific event (elections, debt ceiling, major data releases) in a few months.

A negative curvature, i.e. a dip, signals the market expects calm now and in the distant future, but a shock in the middle.

Event risk often appears here before headlines pick it up.

Figure 4. VIX Term Curvature Slope Shift Illustration. Mid maturities bulge or dip versus the wings. Isolates belly‑focused demand changes. Plot created by author.

Carry Forward Risk:

Carry forward risk appears when the front of the curve recovers faster than the back.

This creates profitable carry trades in contango, i.e. long-dated protection decays, short-term contracts settle lower.

In backwardation, carry flips: front contracts bleed premium, and volatility ETF products see sharp gains or losses.

Watch for carry spread signals; they tell you when the short end expects quick normalization while the long end still prices in uncertainty.

Figure 5. Carry Foward Risk. VX2‑VX1 decays faster than VX6‑VX1. Positive carry when the front spread narrows first; carry flips when VX2‑VX1 turns negative while VX6‑VX1 stays elevated. Plot created by author.

2. Get the VIX Term Structure Data from CBOE

We use vix_utils, a Python wrapper that pulls VIX futures term-structure data directly from CBOE’s public CSV endpoints. Under the hood, it:

Opens an HTTP connection to CBOE’s daily term-structure CSV URLs

Uses aiohttp and asyncio to request all maturities in parallel

Calls

pandas.read_csvon the raw CSV response to build a DataFrame

!pip install -q vix_utils hmmlearnKey fields in the returned df:

Trade Date: Snapshot date for each quote

Expiry: Futures expiration date

Tenor_Days: Days until expiry

Tenor_Monthly: Rounded month count

Settle: Implied volatility level (VIX points)

Weekly / Expired: Flags to exclude illiquid contracts

import warnings

# Suppress FutureWarnings from vix_utils

warnings.filterwarnings(

"ignore",

category=FutureWarning,

module="vix_utils"

)

import nest_asyncio

import asyncio

from vix_utils import async_load_vix_term_structure

# Patch the event loop for nested use

nest_asyncio.apply()

async def get_term_structure():

"""

Load the VIX term structure asynchronously.

Returns a pandas DataFrame.

"""

df = await async_load_vix_term_structure()

return df

# Run the async loader and display the first rows

loop = asyncio.get_event_loop()

df = loop.run_until_complete(get_term_structure())

Figure 6. Snapshot of the raw VIX futures term structure data, which includes trade date, expiry, tenor, and settlement prices across contracts.

Later we’ll use HMMlearn (installed above) in the next section to fit a Gaussian Hidden Markov Model on slope series and classify regimes.

HMMlearn follows the classic scikit-learn conventions and uses the EM algorithm for parameter estimation.

3. Visualize the VIX Term Structure Over Time

We use interactive visualizations to track how the VIX curve shifts, flattens, and inverts over time.

The slider chart shows each day’s term structure.

Each line is a snapshot: expiry on the x-axis, VIX futures price on the y-axis.

The regime label updates with each date, i.e. Contango, Backwardation, or Cautious, based on the slope between front and back contracts.

import pandas as pd

import plotly.graph_objects as go

# user sets start date here

start_date = pd.to_datetime("2020-01-01")

# filter into a new DataFrame; df stays intact

df_sub = df.loc[pd.to_datetime(df['Trade Date']) >= start_date].copy()

df_sub['Trade Date'] = pd.to_datetime(df_sub['Trade Date'])

df_sub.sort_values('Trade Date', inplace=True)

# group by each date with at least two tenors

groups = [

(dt, grp.sort_values('Tenor_Monthly'))

for dt, grp in df_sub.groupby('Trade Date')

if len(grp) > 1

]

# map each date to its regime

regime_map = {}

thr = 0.5

for dt, grp in groups:

slope = grp['Settle'].iloc[-1] - grp['Settle'].iloc[0]

if slope > thr:

regime = "CONTANGO"

elif slope < -thr:

regime = "BACKWARDATION"

else:

regime = "CAUTIOUS"

regime_map[str(dt.date())] = regime

# build the slider figure

fig = go.Figure()

dates = []

for i, (dt, grp) in enumerate(groups):

date_str = str(dt.date())

dates.append(date_str)

fig.add_trace(

go.Scatter(

x=grp['Expiry'],

y=grp['Settle'],

mode='lines+markers',

name=date_str,

visible=(i == len(groups) - 1)

)

)

# slider steps

steps = []

for i, d in enumerate(dates):

title = f"VIX Term Structure — {d} — {regime_map[d]}"

steps.append({

"method": "update",

"args": [

{"visible": [j == i for j in range(len(dates))]},

{"title": title}

],

"label": d

})

fig.update_layout(

sliders=[{

"active": len(dates) - 1,

"currentvalue": {"prefix": "Trade Date: "},

"pad": {"t": 50},

"steps": steps

}],

title=f"VIX Term Structure — {dates[-1]} — {regime_map[dates[-1]]}",

xaxis_title="Futures Expiry",

yaxis_title="VIX Futures Price",

height=500

)

fig.update_layout(

template="plotly_dark",

paper_bgcolor="rgba(0,0,0,1)",

plot_bgcolor="rgba(0,0,0,1)",

title_font_color="white",

font=dict(color="white")

)

fig.show()

Figure 7. VIX term structure over time. Its shows Contago, Catious, Backwardation Regimes.

In steady markets, contango dominates: short-dated contracts sit below the longer-dated ones. The curve slopes up and right.

Contango signals the market expects near-term risk to fade.

Backwardation appears rarely and only when markets panic.

Cautious captures flat or ambiguous curves ahead of event risk.

We now build a different perspective. We plot the futures prices, by trade date (x), days to expiry (y), and price (z).

With this, we can track:

Not just curve shape, but how the entire surface shifts and tilts over months and years.

How volatility events appear as visible bulges or drops. Stress events force the front of the surface sharply higher, while the back often lags.

This surface exposes how long the market expects volatility to last, persistent stress lifts the entire surface, while a localized event creates only a short-lived spike in the front.

import plotly.express as px

import pandas as pd

# --- keep your existing filtering up to `grouped`

monthly_df = df[(df["Weekly"] == False) & (df["Expired"] == False)].copy()

valid_dates = monthly_df['Trade Date'].value_counts()

valid_dates = valid_dates[valid_dates > 1].index.tolist()

monthly_df_filtered = monthly_df[monthly_df['Trade Date'].isin(valid_dates)].copy()

grouped = monthly_df_filtered.groupby("Trade Date")

# Create the 3D plot

fig = px.scatter_3d(

monthly_df_filtered,

x="Trade Date",

y="Tenor_Days",

z="Settle",

color="Settle",

title="VIX Futures Term Structure over Time"

)

fig.update_layout(

scene=dict(

xaxis_title='Trade Date',

yaxis_title='Days to Expiration',

zaxis_title='Settle Price'

)

)

fig.update_layout(

template="plotly_dark",

paper_bgcolor="rgba(0,0,0,1)",

plot_bgcolor="rgba(0,0,0,1)",

title_font_color="white",

font=dict(color="white")

)

fig.show()

Figure 8. Three-dimensional view of VIX futures prices by trade date and time to expiration to show how the entire volatility surface shifts and twists over time. Plot created by author with the code above.

4. Detect Market Regimes with HMM

We classify the VIX term structure into regimes using a Hidden Markov Model fit to the daily slope of the curve.

For each trade date, fit a straight line to the VIX curve and record the slope:

The slope quantifies how much near-term implied volatility differs from long-term contracts.

Standardize the slope series to ensure consistent scale. The HMM segments the time series into the three latent states, based solely on the distribution and persistence of the slopes:

Contango: Curve slopes upward. The market expects volatility to fall.

Backwardation: Curve slopes downward. The market prices immediate risk above future risk.

Cautious: Curve is flat or irregular. The market sits between regimes.

import numpy as np

import pandas as pd

import plotly.express as px

import plotly.graph_objects as go

from hmmlearn.hmm import GaussianHMM

from sklearn.preprocessing import StandardScaler

# --- slope series

base = df[~df['Weekly']].copy() # monthly contracts only

base['Trade Date'] = pd.to_datetime(base['Trade Date'])

rows = []

for d, g in base.groupby('Trade Date'):

g = g.sort_values('Tenor_Days')

if len(g) < 2:

continue

slope = np.polyfit(g['Tenor_Days'], g['Settle'], 1)[0]

rows.append({'Trade Date': d, 'Slope': slope})

slope_df = pd.DataFrame(rows).sort_values('Trade Date')

# --- HMM fit (3 regimes)

X = StandardScaler().fit_transform(slope_df[['Slope']])

hmm = GaussianHMM(

n_components=3,

covariance_type='full',

n_iter=500,

random_state=1

).fit(X)

hidden = hmm.predict(X)

# map each HMM state → label by mean slope

state_mean = pd.Series(hmm.means_.flatten(), index=range(3))

order = state_mean.sort_values().index

label_map = {order[0]: 'BACKWARDATION',

order[1]: 'CAUTIOUS',

order[2]: 'CONTANGO'}

slope_df['Regime'] = [label_map[s] for s in hidden]

# --- plot: scatter by regime + black slope line

fig = px.scatter(

slope_df,

x='Trade Date',

y='Slope',

color='Regime',

opacity=0.6,

title='Daily VIX Curve Slope with Regime States (HMM)'

)

# add straight black line of the slope series

fig.add_trace(

go.Scatter(

x=slope_df['Trade Date'],

y=slope_df['Slope'],

mode='lines',

line=dict(color='black', width=1),

name='Slope (line)'

)

)

fig.add_hline(y=0, line_dash='dash')

fig.update_layout(

xaxis_title='Trade Date',

yaxis_title='Slope (pts / day)'

)

fig.update_layout(

template="plotly_dark",

paper_bgcolor="rgba(0,0,0,1)",

plot_bgcolor="rgba(0,0,0,1)",

title_font_color="white",

font=dict(color="white")

)

fig.show()

# ---transition matrix

trans = pd.DataFrame(

hmm.transmat_,

index=[label_map[i] for i in range(3)],

columns=[label_map[i] for i in range(3)]

)

print("\nTransition probabilities\n")

print(trans.round(3))

Figure 9. This plot measures the daily slope of the VIX curve. Each point is labeled as contango, backwardation, or cautious, based on a Hidden Markov Model classification.

Transition probabilities

CONTANGO CAUTIOUS BACKWARDATION

CONTANGO 0.184 0.811 0.005

CAUTIOUS 0.980 0.001 0.019

BACKWARDATION 0.001 0.022 0.978The regime plot shows extended periods of Contango and occasional transitions into Cautious.

Backwardation appears rarely but sharply but mark true panic.

For example, during the the ‘Liberation Day’ tariff announcement on April 2, markets entered Backwardation:

Front-month futures spiked.

The slope inverted deeply.

The chart shows green dots cluster around early April 2025.

The transition probabilities we derive from the HMM matrix provide the following insights:

Once in Backwardation, the market tends to stay there (~97.8% chance). This reflects persistent fear.

In Cautious, the market reverts to Contango fast (~98%). Cautious is brief and transitional.

Contango tends to shift into Cautious (81%), not directly into panic.

5. Foward Risk: Short vs Long Term Expectations

To see where the market expects volatility to move, compare short-term and long-term VIX futures. This is the logic behind “carry spreads”:

VX2–VX1: Second month minus front month

VX6–VX1: Sixth month minus front month

Both spreads show the gap between immediate risk and what traders price months ahead.

Key signals in the data:

Positive spreads (contango): Near-term volatility trades below the future. The market expects current risk to fade. Volatility ETPs (like VXX, UVXY) lose value as the front rolls up toward the back.

Negative spreads (backwardation): Front-month volatility exceeds the back. The market prices in panic or a short-term event. This flips carry. Short vol products can rally; long vol holders finally get paid.

Wide spreads: A steep curve signals a rapid shift in expectations. If VX2–VX1 spikes while VX6–VX1 remains anchored, the market sees a local shock, not a regime change.

import pandas as pd

import plotly.express as px

# keep all history, only skip weekly futures

monthly_df_full = df[~df['Weekly']].copy()

monthly_df_full['Trade Date'] = pd.to_datetime(monthly_df_full['Trade Date'])

monthly_df_full = monthly_df_full.sort_values('Trade Date')

# wide table: rows = date, cols = tenor

pivot = (

monthly_df_full

.pivot(index='Trade Date', columns='Tenor_Monthly', values='Settle')

.sort_index()

)

# carry spreads (only where both legs exist)

spreads = pd.DataFrame(index=pivot.index)

if {1.0, 2.0}.issubset(pivot.columns):

spreads['VX2-VX1'] = pivot[2.0] - pivot[1.0]

if {1.0, 6.0}.issubset(pivot.columns):

spreads['VX6-VX1'] = pivot[6.0] - pivot[1.0]

spreads = spreads.dropna(how='all')

spreads_long = spreads.reset_index().melt(

id_vars='Trade Date', value_name='Spread', var_name='Leg'

)

fig = px.line(

spreads_long,

x='Trade Date',

y='Spread',

color='Leg',

title='VIX Carry Spreads (Front ↔ 2nd & 6th Month)',

markers=True

)

fig.add_hline(y=0, line_dash='dash')

fig.update_layout(

xaxis_title='Trade Date',

yaxis_title='Spread (points)'

)

fig.update_layout(

template="plotly_dark",

paper_bgcolor="rgba(0,0,0,1)",

plot_bgcolor="rgba(0,0,0,1)",

title_font_color="white",

font=dict(color="white")

)

fig.show()

Figure 10. This chart tracks the spread between the 2nd and 1st, and 6th and 1st VIX futures. A negative spread means near-term volatility trades above longer-term contracts, often during market stress.

Let’s for example consider the 2008 crisis. both VX2–VX1 and VX6–VX1 spreads dropped deep into negative territory.

This means the front-month and second-month VIX futures traded far above longer-term contracts. The market priced in immediate, extreme stress.

As the worst panic faded, the VX2–VX1 spread snapped back toward zero faster than VX6–VX1.

Short-term volatility cooled off, but longer-term contracts stayed elevated. Investors believed the crisis impact would linger.

Even after the initial shock, the curve stayed below zero for VX6–VX1.

This showed that the market expected volatility to remain higher than normal for months.

A trade could have been the following during the recovery of 2008:

Sell short-term volatility, buy long-term volatility

Short the front-month or second-month VIX future

Buy the sixth-month VIX future

Rationale:

As the immediate panic faded, front-month futures reverted lower.

Long-term contracts held elevated levels as investors priced in sustained risk.

This “curve flattening” trade profits as the spread between short and long narrows, i.e. front contracts fall faster, back contracts drift lower more slowly.

In ETF terms:

Reduce or avoid long VIX ETPs (like VXX) as panic peaks since roll yield is most negative.

After the spread narrows, consider re-entering front-end volatility exposure only when curve structure normalizes.

The recovery in VX2–VX1 ahead of VX6–VX1 showed that the fastest gains came from fading short-term volatility, not betting on a quick full normalization.

The trade is to bet on the front recovering first, while staying cautious on the long end.

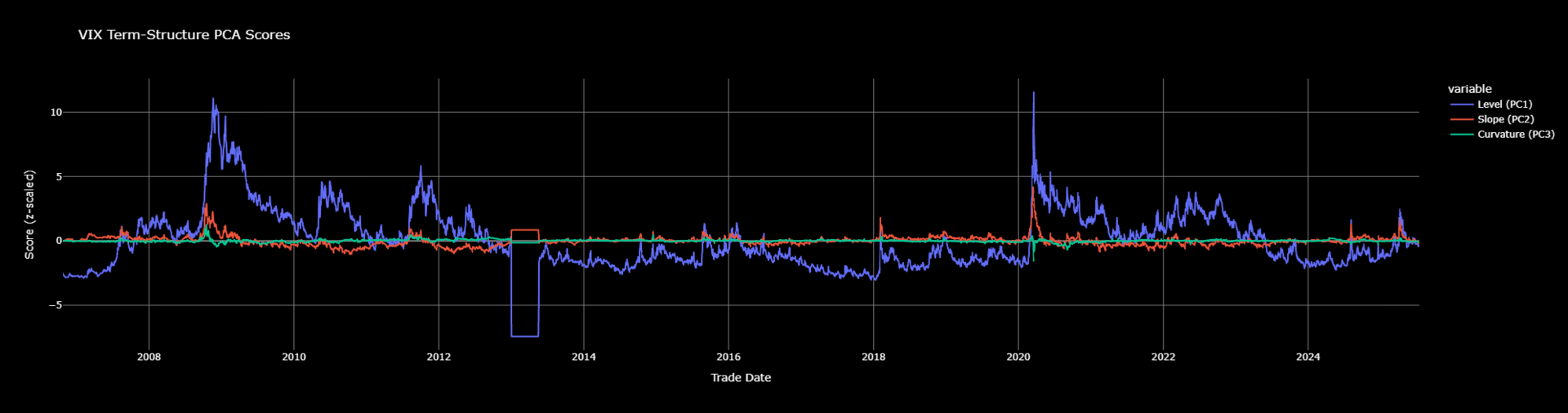

6. Term Structure Level, Slope, Curvature over Time

The VIX curve movements are complex, but three factors explain almost everything: level, slope, and curvature.

With ‘Principal Component Analysis’, we can get an objective way to extract these drivers from the entire curve.

How it works:

Take VIX futures prices across the first six monthly tenors for every trade date.

Standardize each cross-section for fair comparison.

Run PCA:

PC1 (Level): Moves the entire curve up or down.

PC2 (Slope): Tilts the curve, steepening or flattening the front versus the back.

PC3 (Curvature): Bends the middle up or down — captures humps and dips.

import pandas as pd

from sklearn.decomposition import PCA

from sklearn.preprocessing import StandardScaler

import plotly.express as px

# --- data slice: monthly contracts only

pca_df = df[~df['Weekly']].copy()

pca_df['Trade Date'] = pd.to_datetime(pca_df['Trade Date'])

pivot = (

pca_df

.pivot(index='Trade Date', columns='Tenor_Monthly', values='Settle')

.sort_index()

)

cols = [1.0, 2.0, 3.0, 4.0, 5.0, 6.0] # first six monthly tenors

wide = pivot[cols].dropna()

# --- PCA

X = StandardScaler().fit_transform(wide.values)

pca = PCA(n_components=3).fit(X)

# label components

labels = ['Level (PC1)', 'Slope (PC2)', 'Curvature (PC3)']

pc_scores = pd.DataFrame(

pca.transform(X),

index=wide.index,

columns=labels

)

# --- plots

# scores over time

fig_scores = px.line(

pc_scores,

x=pc_scores.index,

y=labels,

title='VIX Term-Structure PCA Scores',

template='plotly_dark'

)

fig_scores.update_layout(

xaxis_title='Trade Date',

yaxis_title='Score (z-scaled)',

paper_bgcolor='rgba(0,0,0,1)',

plot_bgcolor='rgba(0,0,0,1)',

font=dict(color='white')

)

# explained variance

fig_var = px.bar(

x=labels,

y=pca.explained_variance_ratio_,

title='Explained Variance by Component',

template='plotly_dark'

)

fig_var.update_layout(

xaxis_title='Component',

yaxis_title='Variance Share',

paper_bgcolor='rgba(0,0,0,1)',

plot_bgcolor='rgba(0,0,0,1)',

font=dict(color='white')

)

# optional: tweak gridline colors for better contrast

for fig in (fig_scores, fig_var):

fig.update_xaxes(gridcolor='gray', zerolinecolor='gray')

fig.update_yaxes(gridcolor='gray', zerolinecolor='gray')

fig_scores.show()

fig_var.show()

Figure 11. Principal component analysis of the VIX curve, which shows level (PC1), slope (PC2), and curvature (PC3). These factors drive most changes in the term structure.

What the data shows:

Level dominates. During major volatility events (2008, 2020), the whole curve lifts or collapses in sync. Level tells you how much total fear the market prices.

Slope matters most during regime flips. When slope drops, contango disappears. risk becomes immediate.

Curvature shows event risk in the middle of the curve. Spikes here signal the market pricing in a specific known event (Fed meetings, elections) two to four months out.

The explained variance chart makes one thing clear: level (PC1) alone accounts for the bulk of curve movement.

Slope and curvature contribute less, but each marks a different type of risk.

When slope and curvature move together, expect rapid shifts and crowded risk unwinds.

Isolated curvature spikes? Look for upcoming events not yet priced into the front or back months.

Volatility during market shocks:

2008 crisis: All three factors spike. The entire curve shifts up, steepens, and forms a hump. Fear is extreme across all horizons. The market sees both immediate and persistent risk.

COVID Crash: Level and slope surge. Curvature drops sharply negative. Panic is immediate, but the curve bends downward in the middle. The market expects a violent, short-lived shock, with risk normalizing quickly after the front month.

Liberation Day Tariff Shock: Level and slope both spike. The entire curve shifts up and steepens. This signals a fast, front-loaded volatility shock. Curvature stays flat so risk is concentrated in the immediate term, not spread out across the curve.

7. Rolling VIX Futures Proxy (Unlevered Index)

The headline VIX measures 30-day implied volatility. But you can’t buy or sell the index directly.

To track its movement over time, build a rolling VIX futures index. Always holding a synthetic position with exactly 30 days to expiry.

How to build it:

On any date, find the two VIX futures closest to 30 days from expiry — one just below, one just above.

Calculate a weighted average between their settlement prices, proportionate to distance from 30 days.

Each day, roll forward this exposure. Always stay exactly 30 days out, never taking delivery.

If contract A has d1 days to expiry, price p1.

If contract B has d2 days to expiry, price p2:

Chain the returns from this daily blended price to create an unlevered index.

Why construct it this way?

This synthetic approach matches the exposure profile of most VIX ETPs.

It isolates the impact of true volatility changes versus roll yield decay from the futures curve.

It provides a real backtest for any constant-maturity volatility strategy, something spot VIX cannot deliver.

import numpy as np

import pandas as pd

import plotly.express as px

TARGET = 30

START = 1.0

roll_df = df.copy() # keep everything

roll_df['Trade Date'] = pd.to_datetime(roll_df['Trade Date'])

# drop contracts with missing or zero settle

roll_df = roll_df[roll_df['Settle'] > 0]

roll_df = roll_df.sort_values(['Trade Date', 'Tenor_Days'])

records = []

for trade_date, g in roll_df.groupby('Trade Date'):

lo = g[g['Tenor_Days'] <= TARGET].tail(1)

hi = g[g['Tenor_Days'] >= TARGET].head(1)

if lo.empty and hi.empty:

continue

if hi.empty or lo.empty: # only one side available

blend = (hi if not hi.empty else lo)['Settle'].iloc[0]

else: # both sides

d1, p1 = lo.iloc[0][['Tenor_Days', 'Settle']]

d2, p2 = hi.iloc[0][['Tenor_Days', 'Settle']]

if d2 == d1: # same contract hits 30 d

blend = p1

else:

w2 = (TARGET - d1) / (d2 - d1)

blend = p1 + w2 * (p2 - p1)

if blend > 0: # keep only valid prices

records.append({'Trade Date': trade_date, 'Blend': blend})

idx = (

pd.DataFrame(records)

.sort_values('Trade Date')

.assign(Return=lambda x: x['Blend'].pct_change(),

Index=lambda x: START * (1 + x['Return'].fillna(0)).cumprod())

)

fig = px.line(idx, x='Trade Date', y='Index',

title='Constant-Maturity 30-Day VIX Futures Index (unlevered)')

fig.add_hline(y=START, line_dash='dash')

fig.update_layout(xaxis_title='Trade Date', yaxis_title='Index level')

fig.update_layout(

template="plotly_dark",

paper_bgcolor="rgba(0,0,0,1)",

plot_bgcolor="rgba(0,0,0,1)",

title_font_color="white",

font=dict(color="white")

)

fig.show()

Figure 12. Constant-Maturity 30-Day VIX Futures Index (Unlevered). This index holds a synthetic VIX futures position that always targets 30 days to expiry. Each point shows the price you would pay to own 30-day implied volatility, recalculated every day.

The results show:

Sharp upward spikes flag true market panics, i.e. 2008, COVID, policy shocks.

Long, steady drawdowns highlight the hidden cost of carry.

Most of the time, the index trends downward. The only periods of positive return come from violent volatility spikes.

8. Practical Applications and Caveats

How to use the term structure

Traders: Spot regime shifts early by tracking slope and curvature. Contango favors carry trades and short volatility strategies. Backwardation warns to pull risk and reduce exposure to volatility drag.

Risk managers: Use regime and carry signals to stress-test portfolios. Spiking curvature or deep backwardation should trigger risk reviews, especially for derivatives and structured products sensitive to volatility.

Investors: Don’t react to the headline VIX alone. A rising VIX in contango is not the same as a spike in backwardation. Most volatility spikes are short-lived; term structure tells you when to expect normalization.

Classic mistakes

Chasing high VIX prints without looking at curve shape. If the term structure stays in contango, the panic is local and the market expects calm to return. If you buy volatility here, you’ll likely pay peak prices and suffer from roll decay.

Ignoring carry costs. Long volatility products bleed in contango. Roll yield is a tax, not a bonus.

Missing event risk. A dent in the middle of the curve is not noise. Instead, it flags a real risk window. Most get blindsided by these.

What the term structure does not show

Magnitude, not cause. The curve signals that risk exists, not what is driving it. It won’t tell you if the risk is macro, political, or technical.

No guarantee of realized moves. Implied volatility can spike without actual market turbulence. The term structure only reflects pricing, not certainty.

Doesn’t spot slow burns. Prolonged drawdowns can occur even when the VIX curve stays in contango. Not all crises happen overnight.

Concluding Thoughts

The VIX curve is the market’s timeline for uncertainty. Most risk shows up first at the curve’s edges.

Read the structure right, and you see how quickly confidence can snap back or how long nerves really last.

In markets, knowing when fear runs out matters more than most think.

Subscribe to our premium content to read the rest.

Become a paying subscriber to get access to this post and other subscriber-only content.

Upgrade